By Federal Tax Update Staff at Thomson Reuters The IRS has a free online workshop that can help tax-exempt organizations stay exempt. Participants will learn the benefits, limitations and expectations for Section 501(c)(3) organizations. This virtual workshop includes 10 topics of interest to Section 501(c)(3) tax-exempt organizations: Applying for Section 501(c)(3) Status. This course discusses eligibility,…

As an accounting firm, LG&H is an essential service. For the safety of our clients and staff, our office is closed to the public and our staff is working remotely. We can be contacted via phone and email. All returns will be prepared and securely emailed or postal mailed to you. Since most returns are e-filed, we will provide you with a form 8879 for authorization. Please sign and email or fax it to us. If faxing or emailing is not available, we can make other arrangements for your authorization.

We want to extend all the best to you and your families in the troubling time. We are all dealing with many challenges, and will minimize the tax filing process as much as possible.

Sincerely

LG&H

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have questions about filing requirements, contact us. We can ensure you’re meeting all applicable deadlines.January 17…

How much can you and your employees contribute to your 401(k)s next year — or other retirement plans? In Notice 2022-55, the IRS recently announced cost-of-living adjustments that apply to the dollar limitations for pensions, as well as other qualified retirement plans for 2023. The amounts increased more than they have in recent years due…

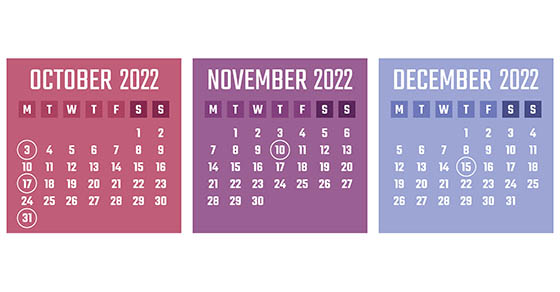

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.Note: Certain…

Although merger and acquisition activity has been down in 2022, according to various reports, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law.Stocks vs. assetsFrom a tax standpoint, a transaction can basically…

Businesses should be aware that they may be responsible for issuing more information reporting forms for 2022 because more workers may fall into the required range of income to be reported. Beginning this year, the threshold has dropped significantly for the filing of Form 1099-K, “Payment Card and Third-Party Network Transactions.” Businesses and workers in…

The IRS has begun mailing notices to businesses, financial institutions and other payers that filed certain returns with information that doesn’t match the agency’s records.These CP2100 and CP2100A notices are sent by the IRS twice a year to payers who filed information returns that are missing a Taxpayer Identification Number (TIN), have an incorrect name…

If you’re in business for yourself as a sole proprietor, or you’re planning to start a business, you need to know about the tax aspects of your venture. Here are eight important issues to consider:1. You report income and expenses on Schedule C of Form 1040. The net income is taxable to you regardless of…

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported…

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a business in the midst of a pandemic. For example, they had more time, wanted to take advantage of new opportunities or they needed money due…